While multi-fleet orchestration platforms continue to grow in popularity, the jury is still out on whether high-level control (or low-level control will be more effective in the long-term.

This month mobile automation vendor, GreyOrange launched its GreyMatter open API, allowing customers to orchestrate and manage multiple fleets of mobile robots from several certified vendors. The need for multi-fleet orchestration is growing in popularity with more and more vendors looking to enter this space. However, how many multi-fleet AMR deployments have there actually been and how big will this market eventually grow?

These are some of the questions we’ve answered in our recent Warehouse Automation Software report and during this insight, we’ll share some of the key findings pertaining to multi-fleet orchestration.

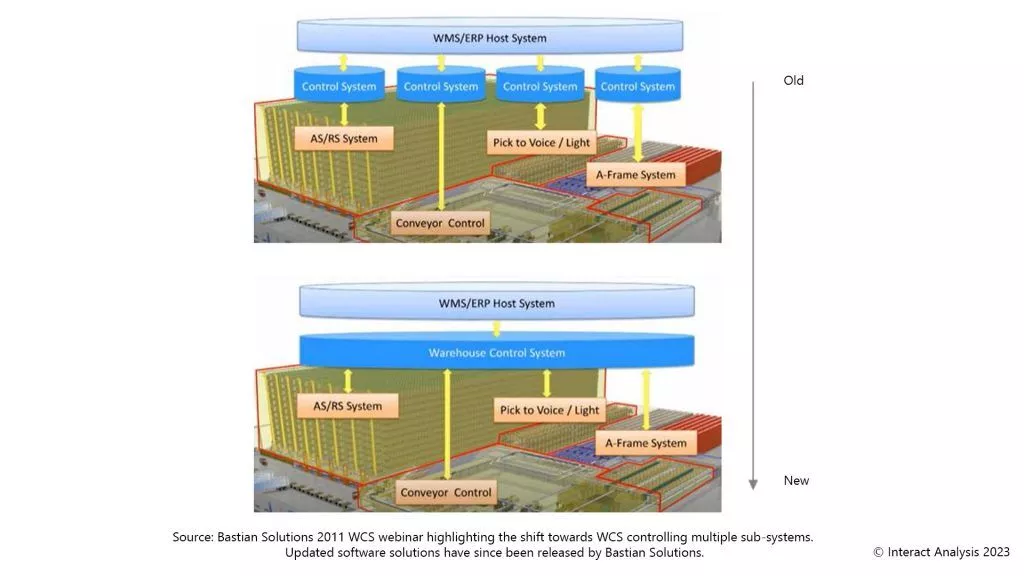

Growing at a forecast CAGR of 138% between 2021 and 2027, the development of multi-fleet orchestration platforms (sometimes referred to as third-party fleet management solutions) has largely mirrored the developments of the WCS (Warehouse Control Software) segment. In the early days of fixed automation, we saw a large number of ‘islands of automation’ where a particular workflow or task was automated. For example, pick-to-light systems or unit-load AS/RS.

Problems arose when warehouses started to use multiple types of fixed automation together. This led to the WMS having to communicate tasks to multiple sub-systems, resulting in inefficiencies as the sub-systems weren’t communicating with one another. As a result, we saw the development of WCS solutions that could interface with multiple types of fixed automation technology, allowing for a level of orchestration across different sub-systems.

Developments of the FMS mirror early WCS solutions. Source: https://www.youtube.com/watch?v=7vCeifk68Do&t=229s

Similarly, we’re now reaching a point where multiple types of mobile robot systems are being used for different workflows. In many cases, manufacturers will develop AMRs for specific workflows. For example, Tompkins Robotics’ T-Sort AMRs are used specifically for sortation. Orchestrating multiple fleets of AMRs from different manufacturers requires a third-party fleet management solution (FMS), sometimes referred to as a multi-fleet orchestration platform. Of course customers could simply integrate AMRs from different vendors into their warehouses as distinct and independent automation ‘blocks’ but that inherently leads to efficiency losses and other challenges when the AMRs are not able to directly communicate with each other.

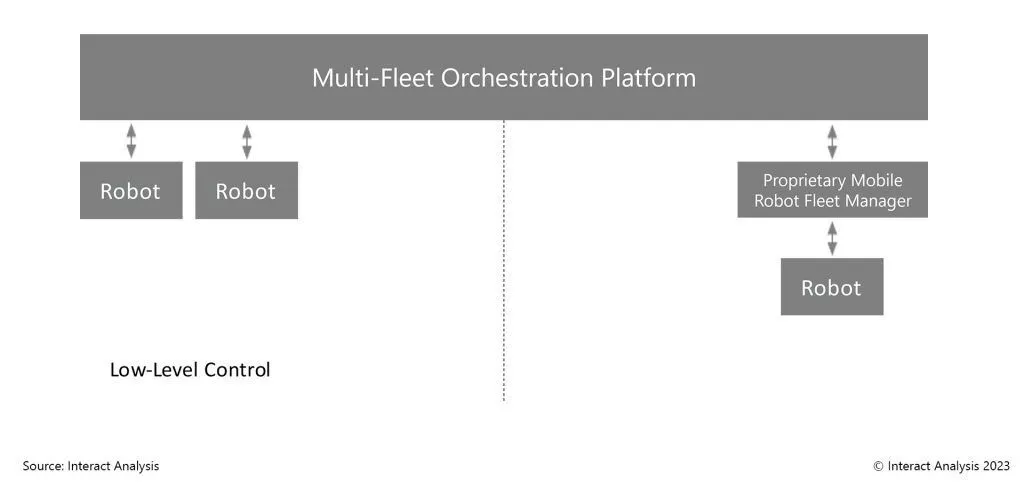

There are two main approaches to multi-fleet orchestration. The most common today is to directly interface with the mobile robots (referred to as ‘Low-Level Control’), allowing the third-party fleet management system to ‘take control’ of the bots. The second approach, which is less common today but growing in popularity, is to have a third-party fleet management system feed tasks to the proprietary fleet management systems of each robot manufacturer (referred to as ‘High Level Control’). In other words, a fleet manager controlling a fleet manager.

Two approaches to multi-fleet orchestration: High-level and low-level control. Courtesy: Interact Analysis.

The first approach of controlling the mobile robots directly works well for point-to-point material transport where the mobile robots have a lot of on-board software and navigation capabilities. Companies like Synaos rely heavily on low-level control. It becomes more difficult when dealing with a complex swarm of bots, such as sortation or goods-to-person AMRs, where the proprietary algorithms used to control the bots include order management and slotting capabilities to optimize throughput. In many cases, a third-party fleet management system would struggle to do a better job than the proprietary software.

This leads to the second approach where a third-party fleet manager would ‘control’ various proprietary fleet managers. The benefit of this approach is that if you have an existing fleet of AMRs or AGVs, you don’t need to re-integrate the fleet management system which can be costly. Furthermore, having a third-party fleet management system integrate directly with a fleet of mobile robots can be more expensive than having a third-party fleet manager control the proprietary fleet manager.

In reality, most platforms are able to provide both high-level control and low-level control, although their preference may be skewed towards a certain approach. Companies like Waku Robotics, CoEvolution, and InOrbit are able to provide both high-level and low-level control.

As we mentioned, there are two main approaches to multi-fleet orchestration. Either integrate directly with the mobile robots (Low-Level Control) or have a third-party fleet manager control the proprietary fleet managers of the mobile robots (High Level Control).

Whilst the first approach of providing low-level control seems logical, there are several costs associated with integrating third-party fleet management systems, especially if the AMR doesn’t have an open API interface. Interoperability will likely have a commoditizing impact on the mobile robot hardware market. The robots themselves tend to be fairly standardized in terms of hardware and it’s the software that’s often the key IP for mobile robot vendors. To avoid commoditization, many mobile robot vendors have made it difficult for third-party fleet management systems to integrate their software with the robots, for example, by having proprietary APIs.

There are two main approaches to tackle the issues around interoperability: 1) creating a standard communication protocols, such as VDA5050, between mobile robots (mainly AGVs) and fleet management systems, and 2) developing middleware to sit between the fleet management system and the robots, acting as a Google Translate of sorts. There are several companies looking to tap into the second category; providing a middleware solution to allow for easier and quicker integrations between robots and third-party applications, like fleet management systems which we cover in more detail in our Warehouse Automation Software report.

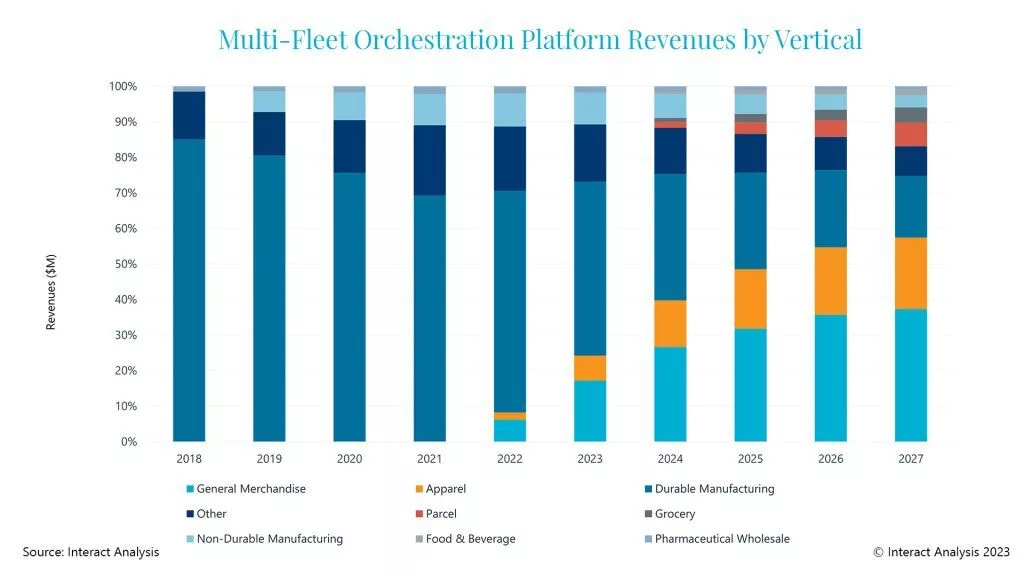

Durable manufacturing dominates the demand for multi-fleet orchestration platforms today. Courtesy: Interact Analysis.

The German automotive industries was one of the first sectors to recognize the importance of interoperability which is why it developed the VDA5050 standards open communication between AMRs and AGVs from different vendors. The German Auto industry‘s involvement does not end there. Audi, VW and BMW have all funded or spun-off companies which provide master control units which are naturally VDA 5050 compliant. These OEMs are deploying the master controllers and software in their plants and this is driving the adoption of the standard as AGV vendors will have to conform to it in order to sell into these high-volume sites. The chart below shows the distribution of revenues from the multi-fleet orchestration market across different sectors. As you can see, durable manufacturing dominates the market and will likely continue to do so in the short- to medium term.

The jury is still out on whether high-level control (controlling proprietary fleet managers) or low-level control (interoperability) will be used long-term to facilitate the orchestration of multiple fleets of mobile robots. Furthermore, the pathway to interoperability may also be driven by common standards or middleware, facilitating the communication between AMRs and AGVs. What is for certain, however, is that we’ll see a growing number of multi-fleet deployments as the market shifts from point solutions to end-to-end mobile automation.

Read more from Control Engineering